ESG

ESG Management

We practice responsible finance by considering environmental and social impacts in all project-related financing activities

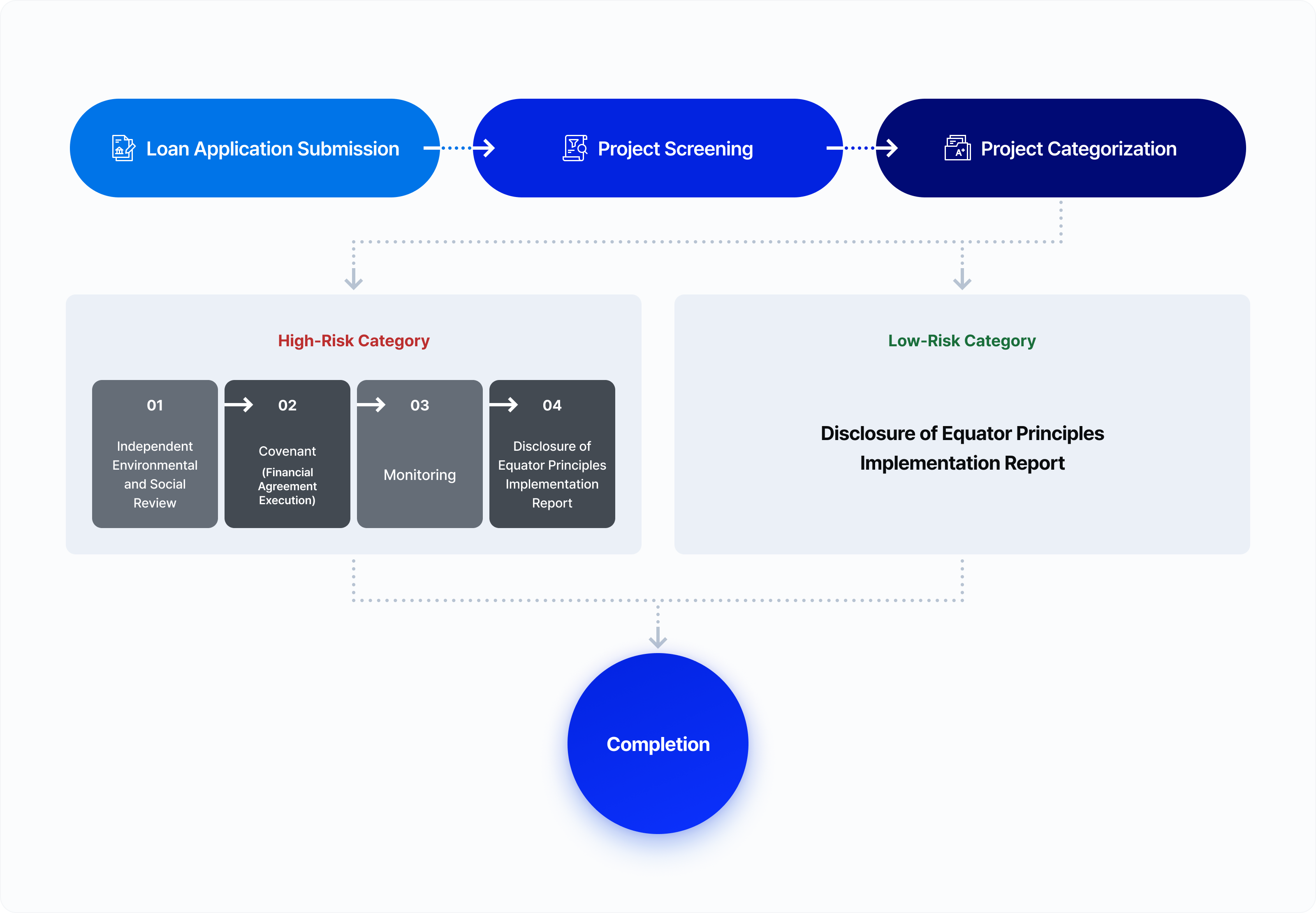

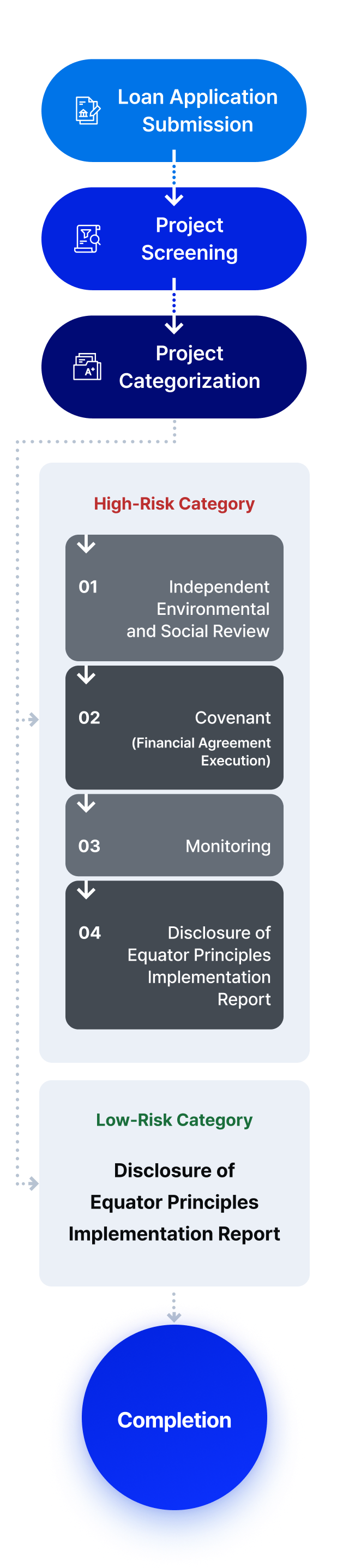

Equator Principles (EPs) Process

Woori Bank adopted the "Equator Principles" in August 2021

to identify and manage environmental and social risks in large-scale projects, ensuring responsible and informed decision-making.

In line with global standards, the Bank has established and operates an Environmental and Social Risk Management Process to systematically assess and manage such risks.

Through this process,

Woori Bank has developed classification criteria and procedures for environmental and social risk ratings in project finance, investments, and corporate lending.

We transparently discloses the outcomes of EPs implementation each June through the publication of its "Equator Principles Implementation Report".

Further details are available in Woori Bank’s ‘Equator Principles Implementation Report’.

- Loan Application Submission

- Project Screening

-

Project Categorization

-

High-Risk Category

- 01 Independent Environmental and Social Review

- 02 Covenant (Financial Agreement Execution)

- 03 Monitoring

- 04 Disclosure

-

Low-Risk Category

Disclosure of Low-Risk Project Counts in the Equator Principles Implementation Report

-

High-Risk Category